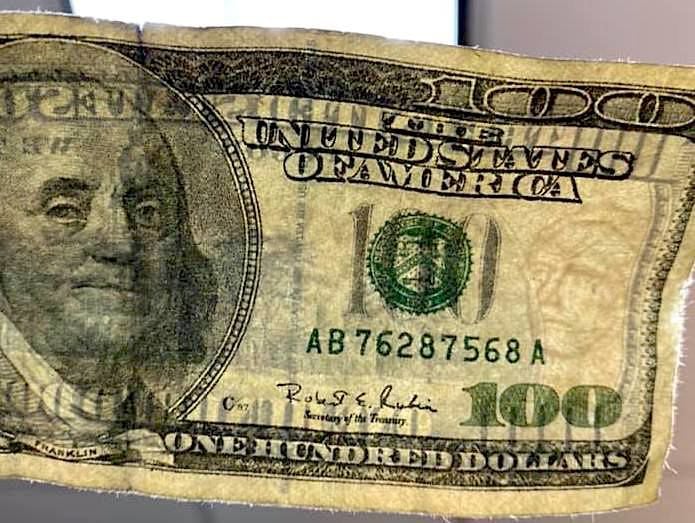

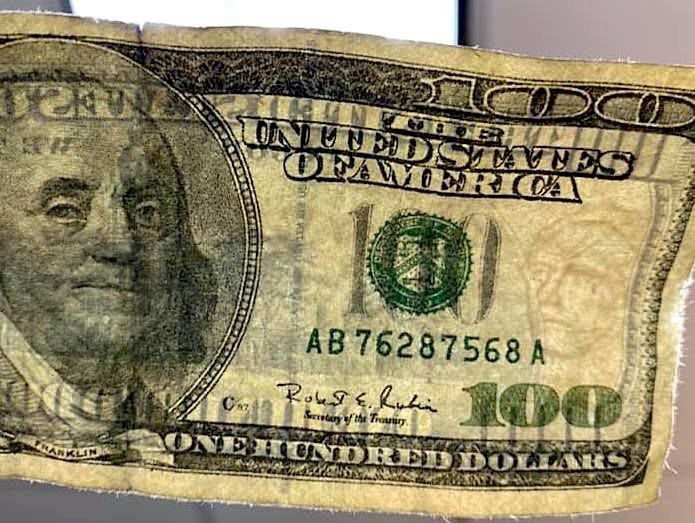

The National Bank of Cambodia (NBC) has introduced four emergency mechanisms to facilitate the circulation of US dollars in Siem Reap. This initiative aims to address challenges associated with old, stained, or damaged US dollars, which have created transaction difficulties in the province.

On Sunday, July 21, 2024, under the recommendation of Prime Minister Hun Manet, H.E. Dr. Chea Serey, Governor of the National Bank of Cambodia, chaired a meeting to discuss facilitating US dollar banknote circulation in Siem Reap with banking and financial institutions. The meeting, held at the National Bank of Cambodia’s Siem Reap branch, included over 60 representatives from banking and financial institutions, as well as provincial authorities. The objective was to find a joint solution to ease the circulation of US dollars in Siem Reap.

During the meeting, the governor asked representatives about their principles regarding the operation of checking and accepting old and torn US dollars. She encouraged them to share their experiences, challenges, and difficulties encountered in receiving US dollars from customers.

After assessing the situation with accepting old or dirty US dollars in shops and private exchanges, and consulting with commercial banks, the National Bank of Cambodia introduced several measures to be implemented in Siem Reap, including emergency and follow-up mechanisms.

Emergency Mechanisms:

Siem Reap Commercial Bank branches are required to accept old or stained US dollars without charging any fees, unless the banknotes are counterfeit.

Very old dollar banknotes that should not continue to circulate can be exchanged for new banknotes at the National Bank of Cambodia’s Siem Reap branch free of charge, without the need to send them to the head office in Phnom Penh.

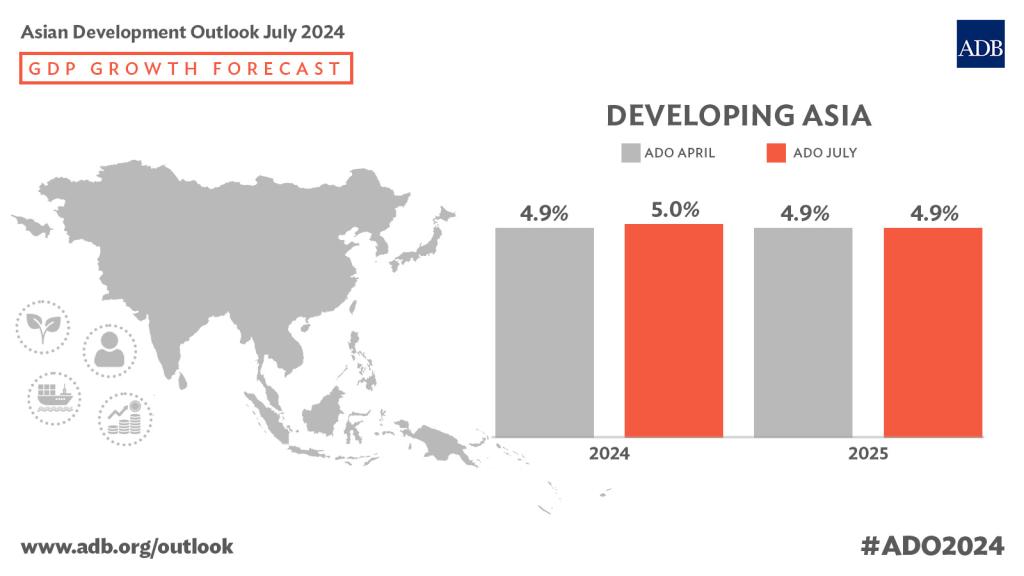

All banking and financial institutions in Siem Reap are required to deposit US $20 and US $50 banknotes instead of US $100 banknotes in ATMs to facilitate tourist spending. Deposits on deposit machines will still be accepted.

Efforts will be made to educate money changers, hotel and restaurant owners to understand and support these measures and cooperate with the National Bank of Cambodia in implementing these mechanisms.

Follow-Up Mechanisms:

Promote the use of the Bakong Tourist App to support tourism in Cambodia by facilitating payments for international tourists.

Collaborate with companies that sell counting machines to establish standards that align the counting machines of the National Bank and commercial banks.

Prime Minister Hun Manet commended H.E. Dr. Chea Serey for her swift action in setting guidelines to ease the distribution of old, stained, or damaged US dollar bills in Siem Reap. He noted that these difficulties had made it hard for people in the province to sell their products, as sellers had conveyed these problems to him during his visit to Pub Street on July 17, 2024.

“I hope that the actions of the National Bank of Cambodia will eliminate the difficulties associated with the issuance of US dollars and facilitate transactions for both locals and tourists in Siem Reap,” said the Prime Minister.

The Prime Minister instructed the NBC branches in Siem Reap, all private banks in Siem Reap, as well as private businesses and merchants, to participate in the new policy to avoid problems related to the distribution of old or stained dollars.